Current Market Volatility

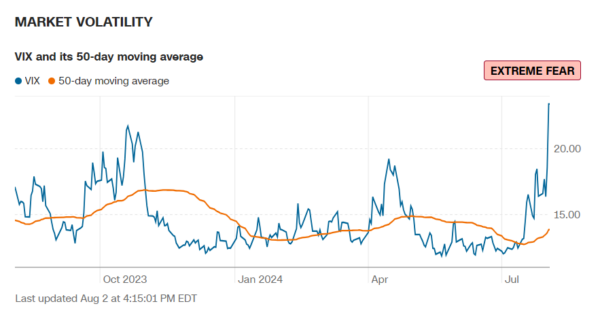

Last week was a rough week in the stock market and today appears to be a continuation of that volatility. There is never a shortage of worries. As the saying goes, the stock market climbs a wall of worry. Currently, recession fears, a bad employment report on Friday, and the unwinding of the Japanese Yen carry trade last week are preoccupying the minds of investors. While not explicitly cited in the reasons, I think the fact we have seen tremendous growth in asset values without much of a breather over the last year plays a role as well. Rather than get into too many details, the traditional measure of fear in the markets, the volatility index (VIX), illustrates the palpable fear right now.

The net result is that the Standard and Poor’s 500 dropped about 3% last week, the Nasdaq dropped over 4% and the small cap index dropped about 7%. Indications this morning as I write this are for further price declines.

During periods of market volatility, it is easy to get wrapped up in the fear. The media has an incentive to bring eyeballs to advertisers. They will most certainly add as much hyperbole to the market volatility as possible to try to keep you glued to their programs. No different than the meteorologists on the local networks taking advantage of the hurricane to drive ratings.

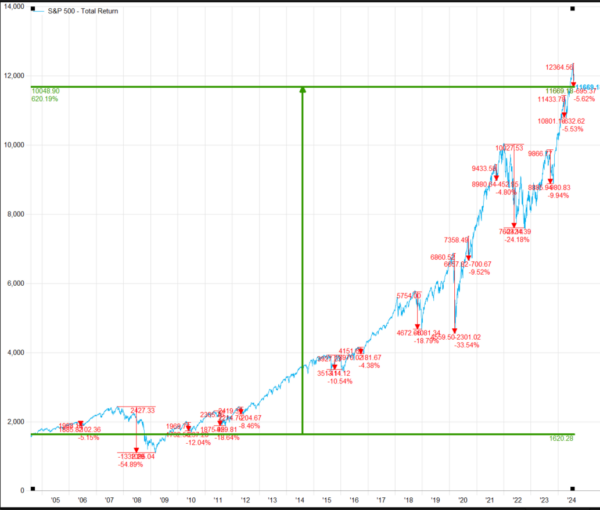

Having managed money for investors going on 25 years now, through three of the worst 5 markets in US history, I have learned it is important to keep perspective in times like these. Below is a chart* of the total return of the Standard and Poor’s 500 index over the last 20 years ending last Friday (Source: FactSet and Standard and Poor’s).

As you can see, the stock index has returned about a 620% cumulative return (the green highlight) over the last 20 years. However, in order to earn that 620% return you had to endure all the red corrections. Many were fairly benign, while others were quite painful. In making this chart, I had to pick and choose where to highlight the pullbacks and corrections. There were so many that if I highlighted them all, the entire chart would be an unreadable red mess. We have built your plan and portfolio to be able to capture the green and be able to ignore the red. I don’t know whether the next 20 years will be better or worse than the last 20, but I believe strongly that we will do well to focus on the long-term green picture and not the short-term red ones.

Two questions come up more than others during periods of market volatility:

When will the market stop going down?

The short answer is that we honestly don’t know. During tumultuous market moves like this one, the market is being driven by emotion, not logic. It would be folly to try to predict when a two-year old’s tantrum will end using logic…the same is true in the markets. Based on market history, we know that these tantrums do end. In the past, the markets have eventually gone on to new highs 100% of the time. While no one knows what the future may hold, we see no reason to believe this time will be different.

At what point should we sell and get out of our investments to stop the decline in the account value?

It is important to think about the stocks you own as actual businesses not pieces of paper. A piece of paper has no value and when the price is dropping a person would be inclined to throw it away easily. However, businesses have an intrinsic value to them. They are very valuable indeed. They are someone’s life’s work. They own assets like real estate and computer networks. They have skilled employees, and in the case of the businesses we own, they generate massive amounts of earnings each year. Can you imagine someone being the sole owner of the largest plumbing company in town or the sole owner of Amazon and selling just because someone offered them a price that was significantly lower than the last price they were offered? No one would do that. Instead, they would ignore the offers and perhaps even be offended by them. In the cases of the price drops we are currently seeing in stocks; we recommend ignoring them. We believe the businesses we own in your portfolio are very valuable and will continue to grow and be worth more in the future. We have worked with you to plan for moments just like this to help ensure you have enough in safer investments like bonds and cash to get to the other side of a market drop. Being prepared allows us to turn the tables. As prices get cheaper, we will look to take advantage as we have in past market corrections, by buying great companies on sale. If someone offers to buy $1 for $0.80, our response shouldn’t be to sell to them because we fear they may offer us $0.70 next, it should be to turn the table and offer to buy their $1 for $0.80. We will be measured in doing so, but we are much more inclined to buy than sell in the portfolio during times like these.

We are here for you. We take our responsibility to you and your family very seriously and are appreciative of our relationship. Please do not hesitate to reach out with any questions or concerns you may have.

Stay safe during the storm (both Debbie and in the markets)!

PM – 02052026-6862537.1.1